alameda county property tax 2021

The valuation factors calculated by the State Board of Equalization and provided to California County Assessors through LTA 2022003 indicate an increase in 2022 values between 20-24 depending on the type of vessel. The first installment is due on November 1 2021 and is delinquent at 5.

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Any deadlines associated with each form filing timeline if a deadline exists.

. Levy to all real property owners of record in the Alameda County Assessors Office. Many vessel owners will see an increase in their 2022 property tax valuations. Search by Parcel Number.

Those instruction pages will provide taxpayers guidance with. 10 2021 9950090 523 North Roxbury Drive. Detailed explanations of each section of the form required information.

A California documentary transfer tax calculated at the rate of 55 for each 50000 or fractional part thereof. The valuation factors calculated by the State Board of Equalization and provided to California County Assessors through LTA 2022003 indicate an increase in 2022 values between 20-24 depending on the type of vessel. The Alameda County Treasurer-Tax Collector Continues to Encourage Online Payment for 2020-2021 Property Taxes.

Secured tax bills are payable online from 1062021 to 6302022. Details of any requirements needed to file the given form. A message from Henry C.

Pay Prior Year Delinquent Tax Available August through June. The valuation factors calculated by the State Board of Equalization and provided to California County Assessors through LTA 2022003 indicate an increase in 2022 values between 20-24 depending on the type of vessel. Please choose from the following tax types.

Other Methods To Pay Pay property tax by phone mail in person and wire transfer. 90029 - Street. Those instruction pages will provide taxpayers guidance with.

Pay Secured Property Tax Available mid October through June. If the payment policy is not adhered to the winning bidder will forfeit their deposit to Alameda County and may be banned from future sales. Secured tax bills are payable online from 1062021 to 6302022.

Prior Year Delinquent tax payments are payable online to 6302023. The fee currently being charged is 225 and it is provided by an outside vendor to facilitate your payment should you be unable to pay the taxes in two installments. Median Sale Price Median Property Tax Sales Foreclosures.

Sign up to receive home sales alerts in. Dear Alameda County Residents. The valuation factors calculated by the State Board of Equalization and provided to California County Assessors through LTA 2022003 indicate an increase in 2022 values between 20-24 depending on the type of vessel.

Pay Supplemental Property Tax Available August through June. Dear Alameda County Residents. The following fees will be added to the final sale price.

A tax bill may also contain special taxes debt service levies on voter-approved debt fees and assessments levied by the county or a city. The following fees will be added to the final sale price. Dear Alameda County Residents.

A property tax bill contains the property tax levied at a one percent tax rate pursuant to the requirement of Proposition 13. Dear Alameda County Residents. Other Methods To Pay Pay property tax by phone mail in person and wire transfer.

Detailed explanations of each section of the form required information. Details of any requirements needed to file the given form. The Alameda County Treasurer-Tax Collector Announces Policies and Procedures for COVID-19 Related Delinquent Property Tax Penalty Interest Waiver.

Any deadlines associated with each form filing timeline if a deadline exists. Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check System. The tax type should appear in the upper left corner of your bill.

Residents of Alameda County where the median home value is 707800 pay an average effective property tax rate of 078 for a median tax bill of 5539. Detailed explanations of each section of the form required information. Being mailed this month by Alameda County Treasurer and Tax Collector Henry C.

Many vessel owners will see an increase in their 2022 property tax valuations. Many vessel owners will see an increase in their 2022 property tax valuations. You can go online to the websiteof the county government and look up your property taxes.

A message from Henry C. Most supplemental tax bills are payable online to 6302023. Those instruction pages will provide taxpayers guidance with.

Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check System. Alameda County Property Tax Payment History. Details of any requirements needed to file the given form.

Information needed to complete each form section. Full payment must be received by Bid4Assets no later than 400 PM ET 100 PM PT on Wednesday March 24 2021. The secured real property taxes payment history is a free service provided by the county of los angeles as a courtesy and is solely intended as an aid to provide secured property tax payment history for the past three fiscal tax years.

Alameda County has one of the highest median property taxes in the United States and is ranked 68th of the 3143 counties in. If the payment policy is not adhered to the winning bidder will forfeit their deposit to Alameda County and may be banned from future sales. Many vessel owners will see an increase in their 2022 property tax valuations.

You can also pay in two installments. The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900. - No exceptions will be made.

There are several ways to pay your property taxes in Alameda County. 2179 Mandeville Canyon Road. The secured roll taxes due are payable by November 1 2021 and will be delinquent by December 10 2021.

Information needed to complete each form section. Any deadlines associated with each form filing timeline if a deadline exists. Alameda County collects on average 068 of a propertys assessed fair market value as property tax.

The State Board of Equalization reviews average retail. Property Tax Cash Payments Accepted by East West Bank. Information needed to complete each form section.

Pay Unsecured Property Tax Available year-round.

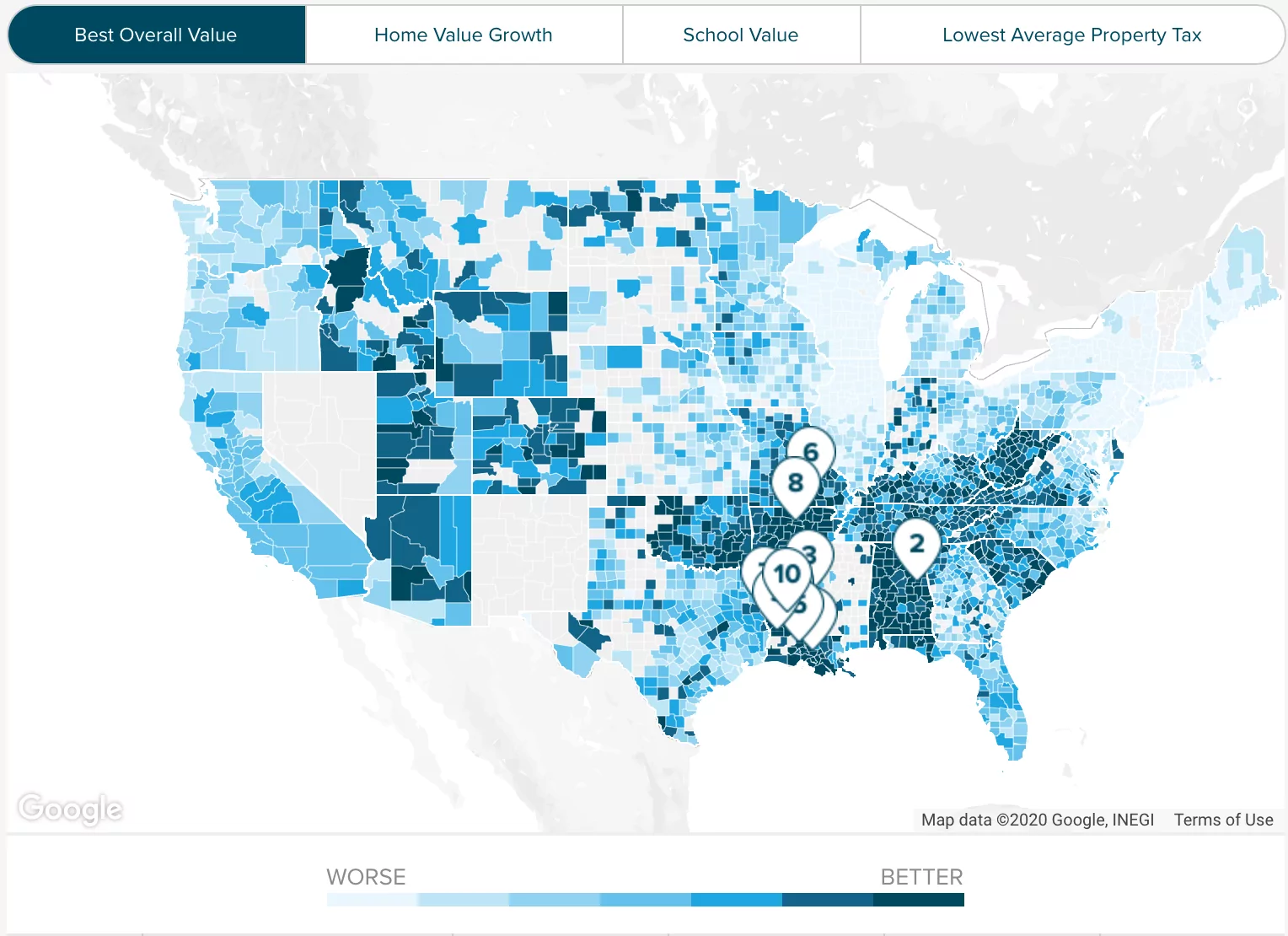

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Alameda County Ca Property Tax Calculator Smartasset

Business Property Tax In California What You Need To Know

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Free Open House Flyers For Realtors 2021 Remarkable Ideas

Alameda County Property Tax News Announcements 11 08 21

Search Unsecured Property Taxes

Decline In Value Review Prop 8 Alameda County Assessor

City Of Oakland Check Your Property Tax Special Assessment

Business Property Tax In California What You Need To Know

Birmingham Mi Real Estate Birmingham Homes For Sale Realtor Com Living Room Dimensions Dining Room Dimensions Bedroom Dimensions

Rental Property Owner Management Kit Rental Owner Printable Etsy Real Estate Investing Rental Property Rental Property Management Rental Property Investment

Business Property Tax In California What You Need To Know

Understanding California S Property Taxes

Business Property Tax In California What You Need To Know

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center